While it can be appealing for some people to get their credit card debt forgiven, there are also disadvantages. It can negatively impact your credit rating and could also have tax implications. Additionally, if the debt is not forgiven, it will be listed as income taxable and you will need to pay taxes.

Bankruptcy

If you need to repay your credit card debt, bankruptcy may be an option. Your creditors are legally prohibited from trying to collect the debt after you file bankruptcy. It means your creditors can't contact you by phone, mail, email, or any other means to collect the debt. Creditors are also prevented from filing lawsuits or any other legal action by bankruptcy. There are exceptions to the automatic stay you need to be aware of before filing bankruptcy.

Bankruptcy could give you a fresh beginning that can help with your financial habits. It can also help you prevent you from making common mistakes, such as ignoring the terms and conditions of credit card offers. It may seem tempting to sign up for credit cards after filing bankruptcy. However, many people don’t take the time necessary to read the fine print. This can often lead to people signing up for high-interest credit card offers.

Although bankruptcy is the fastest method to clear debt, it can have a long-lasting impact on your credit score. Bankruptcy stays on your credit report for seven to 10 years and may hinder your ability to obtain a credit card or a loan in the future. Bankruptcy is a federal court proceeding that completely eliminates all personal debt. Because creditors fear losing their ability to collect the debt, they will negotiate a lower settlement amount.

Debt settlement

You have two options when it comes to settling your credit card debt. Both of these methods can lower your total balance and can improve you financial situation. But which is better? Which one will reduce your stress? And which will improve your credit score? You can find out which method works best for your situation by reading the differences between debt forgiveness and debt settlement.

If you are in default on your payments and your debt is very old, your creditor might agree to a settlement. This can take the form either a lump amount or a monthly payment plan. The terms of a settlement can vary depending on your situation, but the debt will probably be significantly reduced if it's legitimate.

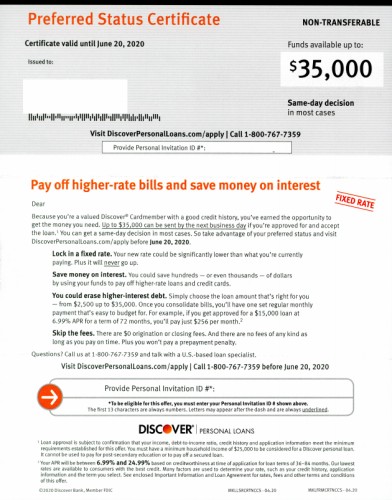

Direct consolidation loans

You should consider the pros and cons of debt consolidation loans before you apply. First, they are more expensive than paying your other debts separately. They might not be available for you if your credit score is low. You should compare the terms of each loan with its interest rates before you make a decision.

Another advantage of debt consolidation is that you can simplify your payments. A single monthly payment will allow you to pay off debts quicker and can lower your interest rate. Be sure to read the terms and conditions as some offer a time limit.

When looking for a debt consolidation loan, it's important to consider the fees and APR offered by different lenders. It's also important to compare the borrowing limits of the different loans. You should select the one that suits your budget and financial goals. After you have found the perfect loan, it is time to submit an application. But, don't forget that you will need to pass a credit check.

FAQ

How do you build passive income streams?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

Understanding their needs and wants is key. It is important to learn how to communicate with people and to sell to them.

The next step is how to convert leads and sales. The final step is to master customer service in order to keep happy clients.

Although you might not know it, every product and service has a customer. And if you know who that buyer is, you can design your entire business around serving him/her.

To become a millionaire takes hard work. To become a billionaire, it takes more effort. Why? You must first become a thousandaire in order to be a millionaire.

Then, you will need to become millionaire. Finally, you must become a billionaire. The same is true for becoming billionaire.

How do you become a billionaire. You must first be a millionaire. To achieve this, all you have to do is start earning money.

Before you can start making money, however, you must get started. Let's look at how to get going.

What's the best way to make fast money from a side-hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

It is also important to establish yourself as an authority in the niches you choose. It means building a name online and offline.

The best way to build a reputation is to help others solve problems. So you need to ask yourself how you can contribute value to the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

However, if you look closely you'll see two major side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

Each method has its own pros and con. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting is a great way to expand your business, without worrying about shipping or providing services. However, it can take longer to be recognized as an expert in your area.

If you want to succeed at any of the options, you have to learn how identify the right clients. This can take some trial and error. But, in the end, it pays big.

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income requires effort and hard work.

Your active income comes from creating value for someone else. If you provide a service or product that someone is interested in, you can earn money. Examples include creating a website, selling products online and writing an ebook.

Passive income can be a great option because you can put your efforts into more important things and still make money. But most people aren't interested in working for themselves. They choose to make passive income and invest their time and energy.

The problem with passive income is that it doesn't last forever. If you wait too long to generate passive income, you might run out of money.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. You should start immediately. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are 3 types of passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You no longer have to worry about paying rent or utilities every month.

It's not enough to learn how money management can help you make more money. It will make you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finances? Everyone does! Personal finance is a very popular topic today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. It leaves just two hours each day to do everything else important.

You'll be able take advantage of your time when you understand personal finance.

Which passive income is easiest?

There are many online ways to make money. Some of these take more time and effort that you might realize. How do you find a way to earn more money?

The solution is to find what you enjoy, blogging, writing or selling. That passion can be monetized.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here are 101 affiliate marketing tips and resources.

A blog could be another way to make passive income. Again, you will need to find a topic which you love teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

While there are many options for making money online, the most effective ones are the easiest. You can make money online by building websites and blogs that offer useful information.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is known content marketing.

How much debt is considered excessive?

It is vital to realize that you can never have too much money. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. When you run out of money, reduce your spending.

But how much is too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. You'll never go broke, even after years and years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. If you make $20,000, you should' t spend more than $2,000 per month. Spend no more than $5,000 a month if you have $50,000.

It's important to pay off any debts as soon and as quickly as you can. This applies to student loans, credit card bills, and car payments. After these debts are paid, you will have more money to save.

You should consider where you plan to put your excess income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. You can still expect interest to accrue if your money is saved.

Let's take, for example, $100 per week that you have set aside to save. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's pretty impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 you would now have $57,000.

It is important to know how to manage your money effectively. You might end up with more money than you expected.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

You can increase cash flow by using passive income ideas

You don't have to work hard to make money online. Instead, you can make passive income at home.

Automation could also be beneficial for an existing business. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

The more automated your company becomes, the more efficient you will see it become. This means you will be able to spend more time working on growing your business rather than running it.

Outsourcing is a great way of automating tasks. Outsourcing allows your business to be more focused on what is important. Outsourcing a task is effectively delegating it.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

Another option is to turn your hobby into a side hustle. A side hustle is another option to generate additional income.

You might consider writing articles if you are a writer. There are plenty of sites where you can publish your articles. These websites offer a way to make extra money by publishing articles.

It is possible to create videos. Many platforms now enable you to upload videos directly to YouTube or Vimeo. These videos will bring traffic to your site and social media pages.

One last way to make money is to invest in stocks and shares. Investing in shares and stocks is similar to investing real estate. You are instead paid rent. Instead, you receive dividends.

When you buy shares, they are given to you as part of your dividend. The amount of the dividend depends on how much stock you buy.

If your shares are sold later, you can reinvest any profits back into purchasing more shares. You will still receive dividends.