A collection agency is a great tool for collecting customer debts. However, you need to be aware of some things before you hire one. First, make sure that the agency is bonded and licensed. You can also verify references. You also need to make sure the collectors you are able to negotiate effectively.

Licensing

Before you can begin working as a collection agency, you will need a license. Many states require licensed agencies have a resident manager, a physical office and a bond against loss. The application fee may be as high as $1,500 depending on the state. Licenses are required to be renewed in most states either annually or biennially. Failure to maintain an active license can lead to criminal or civil penalties. This license is constantly under revision, so it is crucial to ensure that your collection agency is current.

There are different requirements to obtain a license depending on where you live and what type of collection agency it is. You will need a bond for each of your locations if you have multiple locations. A bond is an important way for clients to be protected and to make sure you adhere to state regulations. It can also prevent any headaches down the road.

Bonding

If you plan to open a collection agency, you must submit a bond with the state. These bonds are set at the state level and are based on the financials of your business and your credit rating. You can apply for bonding by contacting a Bonding Services agent. There are many agencies in New York that you can choose to bond with.

The purpose of a collection agency bonds is to protect its clients and to ensure that agency operations are legal. An agency can be sued if they do not obtain a bond because it violates state regulations. Bonds can be used to defend against harassment or unjustified threats of collecting debt. Each state has its own requirements regarding collection agency bonds. This information can be found in the state licensing guide.

Cost

The cost of a collection agent bond depends on many factors. First, the amount and legal precedent of each state will affect the bond's cost. The amount of insurance coverage for surety will also vary. Higher insurance coverage will result in higher premiums. The cost of a collection agency bond will be affected by the credit history and experience of the debt collector.

A contingency fee is another important consideration. In many cases, the fees are based on a percentage of the sums recovered. Keep in mind, however, that not all debts can be collected as quickly. A small account will cost more to pursue than one with a large balance.

Credit scores have an impact

Credit scores can suffer from the effects of collection agencies. A collection agency may report one missed payment as a cause of credit rating downgrading by 110 points. An additional missed payment can cause a 115-point decline. A collection agency's impact upon a credit score can be affected by many factors.

The time that the debt has been delinquent is the most important. The greater the negative effect, the more recent the debt. However, even a 90-day late payment can have a negative effect on your score.

FAQ

How do wealthy people earn passive income through investing?

There are two main ways to make money online. One is to create great products/services that people love. This is called "earning” money.

The second way is to find a way to provide value to others without spending time creating products. This is "passive" income.

Let's say that you own an app business. Your job involves developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. This business model is great because it does not depend on paying users. Instead, you rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how the most successful internet entrepreneurs make money today. They are more focused on providing value than creating stuff.

How to make passive income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

It is important to understand people's needs and wants. This requires you to be able connect with people and make sales to them.

The next step is how to convert leads and sales. You must also master customer service to retain satisfied clients.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

A lot of work is required to become a millionaire. You will need to put in even more effort to become a millionaire. Why? Why?

And then you have to become a millionaire. Finally, you can become a multi-billionaire. The same goes for becoming a billionaire.

How do you become a billionaire. Well, it starts with being a thousandaire. All you have do is earn money to get there.

But before you can begin earning money, you have to get started. So let's talk about how to get started.

Why is personal financing important?

A key skill to any success is personal financial management. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why should we wait to save money? What is the best thing to do with our time and energy?

The answer is yes and no. Yes, because most people feel guilty when they save money. No, because the more money you earn, the more opportunities you have to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

It is important to learn how to control your emotions if you want to become financially successful. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

It is possible to have unrealistic expectations of how much you will accumulate. This is because your financial management skills are not up to par.

These skills will prepare you for the next step: budgeting.

Budgeting means putting aside a portion every month for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Side hustles that are active include tutoring, dog walking, and selling products on eBay.

Side hustles that work for you are easy to manage and make sense. If you love working out, consider starting a fitness business. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

Side hustles are available anywhere. Side hustles can be found anywhere.

Why not start your own graphic design company? Maybe you're a writer and want to become a ghostwriter.

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles don't have to be about making money. They are about creating wealth, and freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

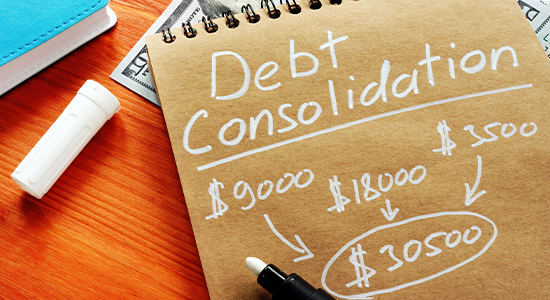

How much debt can you take on?

There is no such thing as too much cash. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. Even after years of saving, this will ensure you won't go broke.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You should not spend more than $2,000 a month if you have $20,000 in annual income. If you earn $50,000, you should not spend more than $5,000 per calendar month.

This is where the key is to pay off all debts as quickly and easily as possible. This applies to student loans, credit card bills, and car payments. You'll be able to save more money once these are paid off.

It would be best if you also considered whether or not you want to invest any of your surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. If you save your money, interest will compound over time.

For example, let's say you set aside $100 weekly for savings. It would add up towards $500 over five-years. You'd have $1,000 saved by the end of six year. In eight years, your savings would be close to $3,000 You'd have close to $13,000 saved by the time you hit ten years.

In fifteen years you will have $40,000 saved in your savings. Now that's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000, you'd now have more than $57,000.

This is why it is so important to understand how to properly manage your finances. If you don't, you could end up with much more money that you had planned.

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income requires hardwork and effort.

When you make value for others, that is called active income. If you provide a service or product that someone is interested in, you can earn money. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income can be a great option because you can put your efforts into more important things and still make money. Many people aren’t interested in working for their own money. So they choose to invest time and energy into earning passive income.

The problem is that passive income doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. Start now. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to make money online

It is much easier to make money online than it was 10 years ago. It is changing how you invest your money. There are many ways to earn passive income, but most require a lot of upfront investment. Some methods can be more challenging than others. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out which type of investor you are. PTC sites (Pay Per Click) are great for those who want to quickly make a quick buck. They pay you to simply click ads. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. Research is essential before you make any commitment to any program. Check out past performance records and testimonials before you commit to any program. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Don't jump straight into one large project. Instead, build something small first. This will allow you to learn the ropes and help you decide if this business is for you. You can expand your efforts to larger projects once you feel confident.

-

Get started now! It's never too soon to start making online money. Even if your job has been full-time for many years, there is still plenty of time to create a portfolio of niche websites that are profitable. All you need to get started is an idea and some hard work. Now is the time to get started!