There are many factors to consider when assessing whether consolidation of debt will cause credit damage. You may believe that consolidating debt is the best solution for you. But, remember that your credit score is affected largely by your payment history. A lower credit utilization ratio can be a positive thing. However, late payments could cause credit damage.

Low credit utilization

You can improve your credit score by ensuring that you have a low credit utilization. Many experts recommend keeping your utilization ratio below 30 percent. However, this ratio will fluctuate with each purchase. While you can occasionally buy a new television or a new car with more than 30 percent of your available credit, you should avoid incurring long-term debt.

To calculate your credit utilization ratio, first figure out how much you owe on each credit card. This number can be found by logging in to your credit card accounts. Divide the total amount by your credit limit to determine the percentage you're using.

Higher interest rates

Consider debt consolidation if your credit cards have not been paid in full. This type is more affordable than credit cards and can improve your credit score. You might be able reduce your monthly payments by combining them in one payment.

Consolidating debt is a great way to simplify your finances by only making one payment, instead of multiple. It can reduce the number of creditors you have, which can reduce the risk of missed payments. Moreover, it can help diversify your credit mix. Additionally, you will be able pay off your debt faster due to lower interest rates.

Higher fees

Consolidating debt can be used to pay off bills but can also cause credit damage. Your credit score is affected by the credit card purchases you make during and after your loan period. Therefore, you need to be very careful about spending too much and using your credit cards too frequently. It is best to have excellent credit and not use credit cards as often as possible.

It is important to compare several providers and obtain quotes from each before choosing a consolidation business. Pay attention to the loan terms, and choose the provider that offers the lowest rate. You must apply for the loan within 2 weeks of receiving your quote.

Lower average credit account age

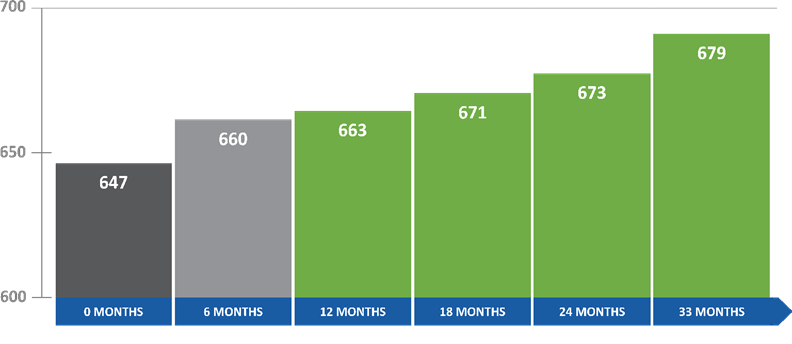

A consolidation loan can reduce your average account age and improve your credit score. Your credit score will be based on how you pay your bills, the amount that you owe and how long you have had open accounts. Credit scores will increase the more you have credit history.

Credit scores can be affected if you have less credit history than 10 years. Nearly 16 years is the oldest account that you have. This means you've probably never opened your credit account by yourself, but your parents might have added you as an authorized use on a credit cards to help you get credit. More credit history is an indicator that you are trustworthy, can pay your bills on schedule, and have a good track record.

FAQ

How to make passive income?

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. It is important to learn how to communicate with people and to sell to them.

Then you have to figure out how to convert leads into sales. To retain happy customers, you need to be able to provide excellent customer service.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

To become a millionaire it takes a lot. To become a billionaire, it takes more effort. Why? Because to become a millionaire, you first have to become a thousandaire.

Then, you will need to become millionaire. Finally, you must become a billionaire. It is the same for becoming a billionaire.

So how does someone become a billionaire? It all starts with becoming a millionaire. All you have to do in order achieve this is to make money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

How can a novice earn passive income as a contractor?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You might even already have some ideas. If you do, great! If not, you should start to think about how you could add value to others and what you could do to make those thoughts a reality.

Online earning money is easy if you are looking for opportunities that match your interests and skills.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

You might also enjoy reviewing products if you are more interested writing. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. That way, you'll stick with it long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main approaches to this. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

Either way, once you have established your rates, it's time to market them. This can be done via social media, emailing, flyers, or posting them to your list.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

When marketing, be a professional. You never know who could be reading and evaluating your content.

-

Know what your topic is before you discuss it. No one wants to be a fake expert.

-

Do not spam. If someone asks for information, avoid sending emails to everyone in your email list. Do not send out a recommendation if someone asks.

-

Use a good email provider - Gmail and Yahoo Mail are both free and easy to use.

-

Monitor your results. You can track who opens your messages, clicks links, or signs up for your mail lists.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

You can try different tactics to find the best one.

-

Learn new things - Keep learning to be a marketer.

Why is personal financial planning important?

For anyone to be successful in life, financial management is essential. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why do we delay saving money? Is there anything better to spend our energy and time on?

Yes and no. Yes because most people feel guilty about saving money. Because the more money you earn the greater the opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. Negative thoughts will keep you from having positive thoughts.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This could be because you don't know how your finances should be managed.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting means putting aside a portion every month for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

What is the easiest passive income?

There are tons of ways to make money online. Many of these methods require more work and time than you might be able to spare. So how do you create an easy way for yourself to earn extra cash?

You need to find what you love. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here are some examples of 101 affiliate marketing tools, tips & resources.

Another option is to start a blog. It's important to choose a topic you are passionate about. You can also make your site monetizable by creating ebooks, courses and videos.

Although there are many ways to make money online you can choose the easiest. You can make money online by building websites and blogs that offer useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known content marketing.

What is the limit of debt?

It's essential to keep in mind that there is such a thing as too much money. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. Spend less if you're running low on cash.

But how much can you afford? There is no universal number. However, the rule of thumb is that you should live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

The key here is to pay off debts as quickly as possible. This includes student loans, credit cards, car payments, and student loans. After these debts are paid, you will have more money to save.

You should also consider whether you would like to invest any surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Consider, for example: $100 per week is a savings goal. That would amount to $500 over five years. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. Now that's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 in savings, you would have more than 57,000.

This is why it is so important to understand how to properly manage your finances. A poor financial management system can lead to you spending more than you intended.

What is personal financing?

Personal finance involves managing your money to meet your goals at work or home. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You won't have to worry about paying rent, utilities or other bills each month.

You can't only learn how to manage money, it will help you achieve your goals. It can make you happier. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

What does personal finance matter to you? Everyone does! Personal finance is one the most sought-after topics on the Internet. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. That leaves only two hours a day to do everything else that matters.

Personal finance is something you can master.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means you need to be able do more than wait for someone else to click your link or purchase your product. You can't make money sleeping.

This requires you to create an automated system that makes money without you having to lift a finger. You must learn the art of automation to do this.

It would be helpful if you could become an expert at creating software systems that automatically perform tasks. That way, you can focus on making money while you sleep. You can even automate the tasks you do.

The best way to find these opportunities is to put together a list of problems you solve daily. You can then ask yourself if automation is possible.

Once you have done this, you will likely realize that there are many ways you can generate passive income. You now need to decide which one would be the most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds to choose from.

Automating anything is possible as long as your creativity can solve a problem. Automation is the key to financial freedom.