Low interest loans are the best option when looking for debt consolidation loans. Look for loans with fixed rates of repayment if you can. Finally, stay away from scams. You can use these tips to find the best loan consolidation for you.

A low-interest consolidation loan is available

You must assess your financial situation before you apply for a consolidation loan. Lenders will examine your income and credit scores to determine if you are able to afford the monthly payments. Your credit report will show whether your score is at the cutoff. This will make it much easier for you to get approved.

Consolidating your debt with a loan can help you out of financial trouble and pay off your credit card balances. These loans may not be for everyone. People with poor credit will have high interest rates. Consider a home equity loan for low-interest loans.

Calculate loan amount

Before you decide to take out a consolidation loan for your debt, it is important that you know how much money you are able to afford. The amount of your loan depends on your income and other factors, including the balances of your existing debts. A debt consolidation calculator is a great tool to help you decide which consolidation option works best for you. You can enter your current debt amounts, monthly payments, interest rates, and other pertinent information. Once you have entered these information, the calculator calculates your monthly payment.

Once you know how much you can afford to borrow, you can decide which repayment plan is right for you. A debt consolidation loan combines multiple loans to make it possible for you to repay your debts quicker. This method can also save you money in the long run.

You should look for fixed-rate payment options

There are many lenders who specialize in personal loans for consolidating debt. Look for a loan with flexible repayment terms that suit your financial situation and budget. First Midwest Bank and Discover offer loans with fixed rates of less than 6.6% APR. They also don't charge origination fees. Look for the loan that best suits your credit score. Lenders that specialize in bad credit loans are available.

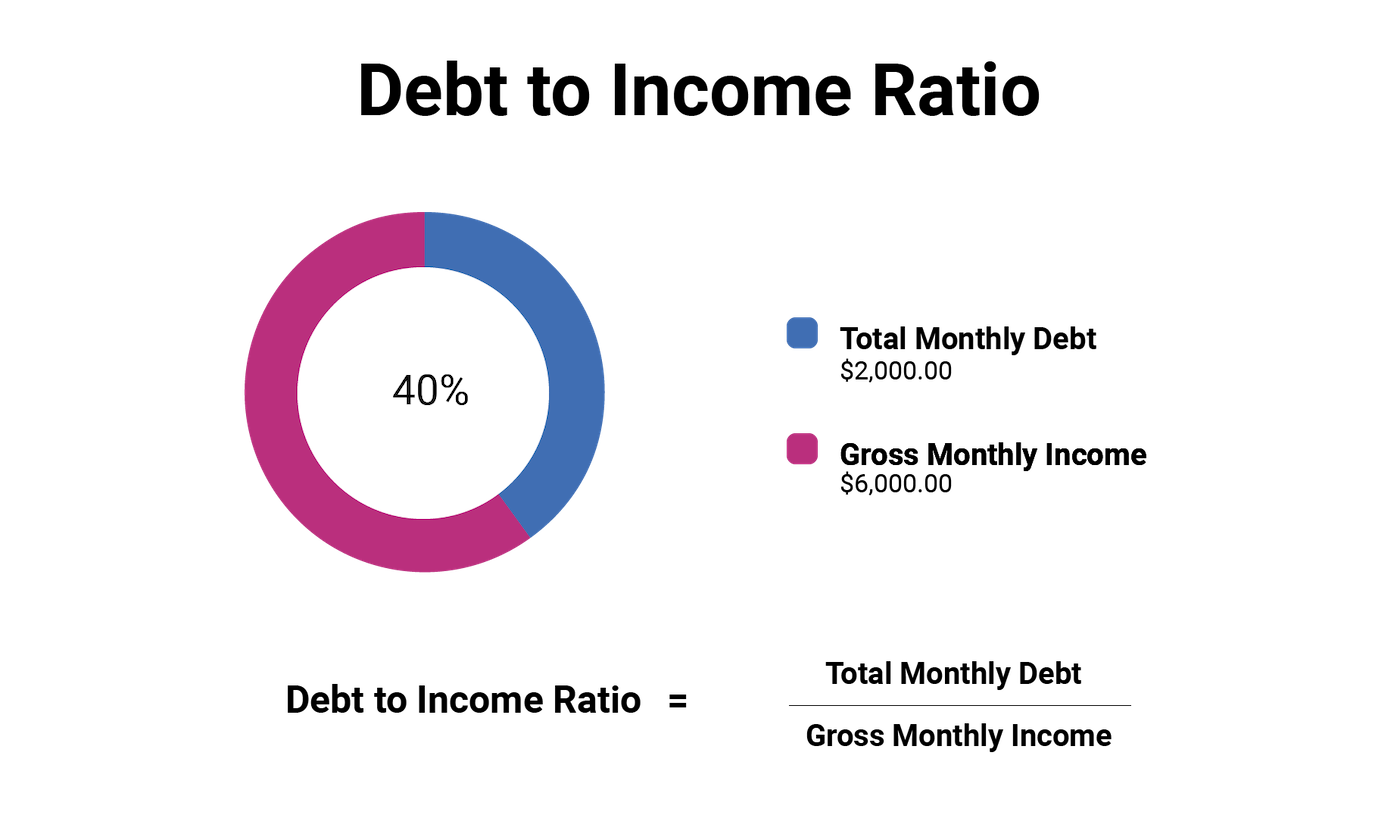

The best debt consolidation loan will have a lower APR than the total of your current debts. A lower interest rate will allow you to pay off your loan over time and make it more affordable. Also, the loan should have an affordable repayment term and low- or no fees. These are the most important features to consider when choosing a loan consolidation loan. Most lenders offer adjustable-rate and fixed-rate loans. Your interest rate will depend on your credit score, income level, and debt-to-income ratio.

Beware of scams

A background check is an important step in finding the right company to consolidate your debt. Look for a Better Business Bureau rating, and make sure their website has a lock symbol. It should also provide a physical location. It is also important to ensure that the website does not contain any common scam signs.

A lead generation website can be a sign that the scammer is trying to sell you something. Many lead generation websites pose as legitimate companies. However, they are just referral services. Although this does not necessarily indicate that they are scams but you need to be sure you are dealing with a legitimate loan provider, and not an intermediary who has not been thoroughly vetted. Be wary of lead generation websites that claim to be affiliated or Native American tribes. These organizations might have a license or agreement with Indian Tribes.

FAQ

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. If you do this well the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. When you were little, you took your mommy's breastmilk and it gave you life. The best place to live was the one you created when you learned to walk.

Giving value to your friends and family will help you make more. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

Today, Earth is home for nearly 7 million people. Each person creates an incredible amount of value every day. Even if only one hour is spent creating value, you can create $7 million per year.

It means that if there were ten ways to add $100 to the lives of someone every week, you'd make $700,000.000 extra per year. Imagine that you'd be earning more than you do now working full time.

Now, let's say you wanted to double that number. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day there are millions of opportunities for creating value. This includes selling products, ideas, services, and information.

Although our focus is often on income streams and careers, these are not the only things that matter. The real goal is to help other people achieve their goals.

Create value to make it easier for yourself and others. You can start by using my free guide: How To Create Value And Get Paid For It.

How can a beginner generate passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You might have some ideas. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

Find a job that suits your skills and interests to make money online.

For example, if you love creating websites and apps, there are plenty of opportunities to help you generate revenue while you sleep.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. It will be a long-lasting commitment.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

There are two main options. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In each case, once your rates have been set, you will need to promote them. You can share them on social media, email your list, post flyers, and so forth.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

Be a professional in all aspects of marketing. You never know who will review your content.

-

Be knowledgeable about the topic you are discussing. A fake expert is not a good idea.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. For a recommendation, email it to the person who asked.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results: Track how many people open your messages and click links to sign up for your mailing list.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Ask your family and friends for feedback.

-

You can try different tactics to find the best one.

-

You must continue learning and remain relevant in marketing.

What is the difference in passive income and active income?

Passive income is when you make money without having to do any work. Active income requires hardwork and effort.

When you make value for others, that is called active income. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. They choose to make passive income and invest their time and energy.

The problem is that passive income doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

It is possible to burn out if your passive income efforts are too intense. It is best to get started right away. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types or passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

What is the fastest way you can make money in a side job?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. It is important to establish a good reputation online as well offline.

Helping others solve their problems is a great way to build a name. It is important to consider how you can help the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

There are pros and cons to each approach. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting is a great way to expand your business, without worrying about shipping or providing services. It takes more time to become an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. This requires a little bit of trial and error. But, in the end, it pays big.

How do you build passive income streams?

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

Understanding their needs and wants is key. It is important to learn how to communicate with people and to sell to them.

Next, you need to know how to convert leads to sales. You must also master customer service to retain satisfied clients.

Every product or service has a buyer, even though you may not be aware of it. If you know the buyer, you can build your entire business around him/her.

A lot of work is required to become a millionaire. You will need to put in even more effort to become a millionaire. Why? Why?

And then you have to become a millionaire. Finally, you can become a multi-billionaire. The same goes for becoming a billionaire.

So how does someone become a billionaire? It starts with being a millionaire. All you have to do in order achieve this is to make money.

But before you can begin earning money, you have to get started. Let's take a look at how we can get started.

What is personal finance?

Personal finance is about managing your own money to achieve your goals at home and work. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You won't have to worry about paying rent, utilities or other bills each month.

You can't only learn how to manage money, it will help you achieve your goals. It makes you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

So who cares about personal finance? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. You can find blogs about investing here, as well as videos and podcasts about personal finance.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. It leaves just two hours each day to do everything else important.

When you master personal finance, you'll be able to take advantage of that time.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

Online success requires that you learn to sleep well while awake. You must learn to do more than just wait for people to click on your link and buy your product. Make money while you're sleeping.

This means you must create an automated system to make money, without even lifting a finger. To do that, you must master the art of automation.

It would help if you became an expert at building software systems that perform tasks automatically. So you can concentrate on making money while sleeping. Automating your job can be a great option.

To find these opportunities, you should create a list with problems that you solve every day. Then ask yourself if there is any way that you could automate them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. Now, it's time to find the most lucrative.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. If you are a designer, you might be able create templates that automate the creation of logos.

Perhaps you are a business owner and want to develop software that allows multiple clients to be managed at once. There are many options.

Automating anything is possible as long as your creativity can solve a problem. Automation is key to financial freedom.