Lowering credit card interest rates can be difficult. Your first contact may not always be the best. Even if you have a strong payment history, your first contact may not be able to reduce your interest rate. Make sure you emphasize your great customer service skills and payment history. It is also important to mention competing offers.

Alternatives to lower credit-card interest rates

There are a few different methods you can use to negotiate with your credit card company and get a lower interest rate. First of all, make note of your current APR, how often you use the card, and how much you typically charge. This information will help you negotiate with your lender. Notify the lender if you have any other cards with lower APRs. This will remind lenders to move your business elsewhere if your rate is not reduced.

You may be eligible for lower interest rates if the balance is paid off in full each month. There are different policies for rate decrease requests from different credit card companies. They will also look at your credit history to determine if you should be granted a lower rate.

Other options for negotiating lower credit card rates

People who wish to lower their credit card interest rates have many options. Call your credit card issuer to explain why you would like a reduction. Make sure you mention your credit history as well as your credit score. You should also mention your interest in a lower interest rate.

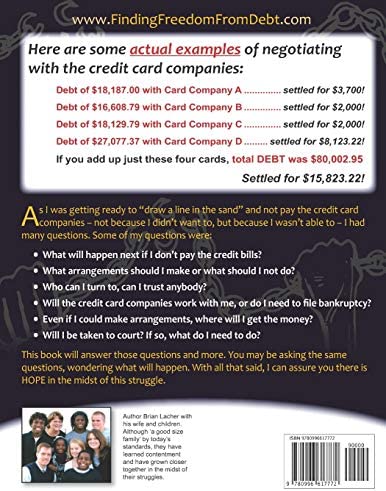

Consolidating your credit cards balances is another option. Both options will reduce your monthly costs and increase your interest rates. These methods will not impact your credit score in many cases. Consolidation methods may result in credit reporting inquiries. Another credit card offer can help you negotiate lower rates.

Your credit card company may be more inclined to lower your rates, if you ask them. These methods may not be foolproof but they can save you money over the course a year. This process takes only 15 minutes and can even result in a lower rate of interest.

Alternatives to lowering credit card interest rates by making on-time payments

You can lower your interest rates by making regular payments to your credit card. This will enable you to save money and reduce the amount of debt that you have. This is a crucial step as defaulting on your loan could leave a permanent mark on your credit score for many years.

Another way to lower your interest rate is to negotiate with your credit card companies. They are known for lowering the interest rates of clients by reducing minimum monthly payments. Some of these negotiation tactics will not affect your credit score, while others may require inquiries.

Credit card companies are not required by law to lower the interest rate. However, they will consider it if you request. Compare your current rate against other interest rates. Try to obtain more information from the credit card company if you are denied. If you do not get an instant reduction, you may have to wait for a longer period of time and make more on-time payments until your interest rate drops.

FAQ

What is the distinction between passive income, and active income.

Passive income can be defined as a way to make passive income without any work. Active income requires work and effort.

Your active income comes from creating value for someone else. When you earn money because you provide a service or product that someone wants. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income can be a great option because you can put your efforts into more important things and still make money. However, most people don't like working for themselves. People choose to work for passive income, and so they invest their time and effort.

Passive income doesn't last forever, which is the problem. If you wait too long to generate passive income, you might run out of money.

It is possible to burn out if your passive income efforts are too intense. So it's best to start now. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types to passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Why is personal finance so important?

If you want to be successful, personal financial management is a must-have skill. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

Why do we delay saving money? Is there anything better to spend our energy and time on?

Yes and no. Yes, because most people feel guilty when they save money. No, because the more money you earn, the more opportunities you have to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

It is important to learn how to control your emotions if you want to become financially successful. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because your financial management skills are not up to par.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting refers to the practice of setting aside a portion each month for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

How much debt can you take on?

There is no such thing as too much cash. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. When you run out of money, reduce your spending.

But how much should you live with? While there is no one right answer, the general rule of thumb is to live within 10% your income. That way, you won't go broke even after years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

Paying off your debts quickly is the key. This includes credit card bills, student loans, car payments, etc. After these debts are paid, you will have more money to save.

You should also consider whether you would like to invest any surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. If you save your money, interest will compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. In five years, this would add up to $500. Over six years, that would amount to $1,000. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. It's impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000, you'd now have more than $57,000.

This is why it is so important to understand how to properly manage your finances. If you don't do this, you may end up spending far more than you originally planned.

How do rich people make passive income?

There are two options for making money online. One is to create great products/services that people love. This is known as "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is called passive income.

Let's imagine you own an App Company. Your job is to develop apps. Instead of selling apps directly to users you decide to give them away free. This business model is great because it does not depend on paying users. Instead, advertising revenue is your only source of income.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how most successful internet entrepreneurs earn money today. They give value to others rather than making stuff.

What is the easiest passive source of income?

There are many ways to make money online. Most of them take more time and effort than what you might expect. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing. You can find plenty of resources online to help you start. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You could also consider starting a blog as another form of passive income. Again, you will need to find a topic which you love teaching. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many online ways to make money, but the easiest are often the best. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is known as content marketing and it's a great way to drive traffic back to your site.

What side hustles will be the most profitable in 2022

It is best to create value for others in order to make money. This will bring you the most money if done well.

It may seem strange, but your creations of value have been going on since the day you were born. When you were a baby, you sucked your mommy's breast milk and she gave you life. When you learned how to walk, you gave yourself a better place to live.

You'll continue to make more if you give back to the people around you. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. It doesn't matter if you're cooking dinner or driving your kids to school.

In fact, there are nearly 7 billion people on Earth right now. That means that each person is creating a staggering amount of value daily. Even if your hourly value is $1, you could create $7 million annually.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. Think about that - you would be earning far more than you currently do working full-time.

Now let's pretend you wanted that to be doubled. Let's assume you discovered 20 ways to make $200 more per month for someone. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling ideas, products, or information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Helping others achieve theirs is the real goal.

You can get ahead if you focus on creating value. Use my guide How to create value and get paid for it.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money While You Are Asleep

You must be able to fall asleep while you're awake if you want to make it big online. This means you need to be able do more than wait for someone else to click your link or purchase your product. You can't make money sleeping.

This requires that you create an automated system which makes money automatically without having to do anything. To do that, you must master the art of automation.

You would benefit from becoming an expert at developing software systems that perform tasks automatically. So you can concentrate on making money while sleeping. You can even automate your job.

The best way to find these opportunities is to put together a list of problems you solve daily. Then ask yourself if there is any way that you could automate them.

Once you do that, you will probably find that there are many other ways to make passive income. Now, it's time to find the most lucrative.

For example, if you are a webmaster, perhaps you could develop a website builder that automates the creation of websites. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

Perhaps you are a business owner and want to develop software that allows multiple clients to be managed at once. There are many options.

Automating anything is possible as long as your creativity can solve a problem. Automating is key to financial freedom.